BEST FINANCIAL ADVISORS

Good financial planning software is an essential tool for today’s financial advisor. Yet the reality is that it’s incredibly difficult to determine what is the best financial planning software, in part because advisors vary in how they use financial planning software in the first place, which means what is the “best” software for one advisor may be a terrible match for another.

In this financial advisor’s guide to the best financial planning software, we attempt to clarify what the important criteria are in choosing financial planning software in the first place, in recognition that what might be a crucial “deal-killer” required feature for one advisor may not even matter to another. Whether it’s the distinction between goals-based and cash-flow-based retirement projections, to the ease of input, the depth of the output (especially in technical areas like detailed income and estate tax projections), available integration to other components of the financial advisor technology stack, or the availability of account aggregation and “PFM” tools, the reality is that no financial planning software is the “best” at everything, so trade-offs must be considered.

In addition, as someone who’s seen virtually every financial planning software company in the landscape – including some that aren’t even around anymore – the end of this guide includes my own brief high-level review of each of the leading financial planning software packages (including some of the newest players, too), to give further context to each software package’s strengths and potential weaknesses. Also included are the pricing details of the various financial planning software packages, which still have a remarkably amount of variance for what are nominally “similar” financial planning software tools!

How To Effectively Use Financial Planning Software

Investments, insurance, income taxes, estate taxes, retirement plans, budgeting, college funding … financial planners must thoroughly explore each of these issues for their clients, and then assist them with implementing their recommendations. Of course, each of these issues can be quite complex on its own, let alone when combined with all of the other facets of a client’s financial picture. Fortunately, modern technology has provided financial advisors with a wide array of powerful computer programs that are able to calculate, synthesize and present comprehensive financial plans that address all areas of a client’s finances. This article examines the nature and function of these programs and the types of programs that may be appropriate for a given type of client.

Which Program Is Best?

Although there are a few financial planning programs that are generally considered to stand out above the rest in terms of sheer computing power and financial and mathematical complexity, this type of program may not necessarily be appropriate for many types of clients. There are many factors that advisors must consider when choosing a program. Some of these include:

-

Computing power – ability to make sophisticated mathematical calculations for investments, tax and estate planning.

-

Comprehensiveness – modules for every aspect of personal finance versus one or two.

-

Presentation – graphics, such as bar and line charts, color coding and other visual aids.

-

Cost – both the initial cost and the price of annual updates and revisions.

-

Investment scenarios – consider whether the program use actual historical data vs. hypothetical returns, individual security analysis.

Many programs that are designed to address more complex issues often present their results in some sort of spreadsheet format, while simpler programs may use a power point or similar style of visual presentation instead.

The Client Factor

Of course, one of the main criteria that advisors choosing a program must consider is the type of clientele that the advisor works with; an advisor who works with corporate executives, small business owners or high net-worth clients will obviously need programs that can perform complex tax and investment calculations. Someone who specializes in working with senior citizens, blue collar workers or the military should probably consider a program that contains more simplified calculations or estimations and easy-to-read and understand visual presentations. Some programs can break down the same information in several different formats, such as pie or bar charts or numerically. Programs that allow clients to choose the method of presentation used may have more educational value than single-format models.

Cost and Value

Financial planning programs can cost anywhere from a few hundred to a few thousand dollars to purchase, and the cost of annual updates and revisions can easily run into hundreds of dollars per year as well. Although the more expensive programs are generally more sophisticated and comprehensive, there are several programs available with modest pricing structures that can compete with top-of-the-line packages in many respects. But the value of these programs must be weighed against their cost. Clients who can see their entire financial picture in a single report may be much more able to understand and follow their planner’s recommendations.

Comparison Table: Financial Planning Softwares

|

AceMoney |

When it comes to financial planning software reviews, AceMoney has consistently received high scores every year.

|

|

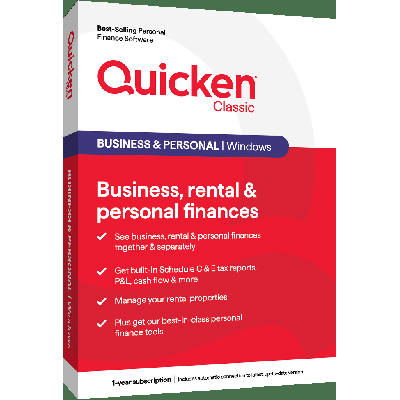

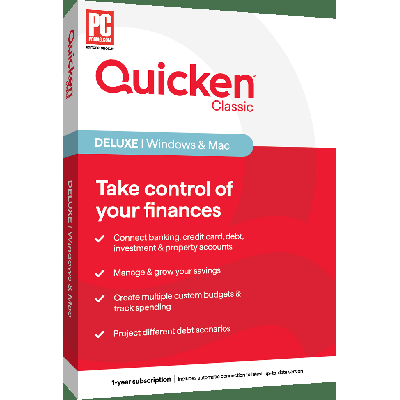

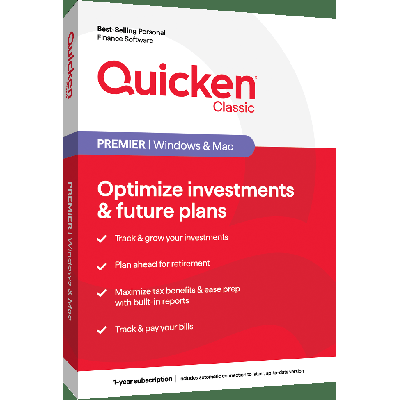

Quicken |

Quicken is not a free software; however, it does have three versions to meet a wide range of user needs (Starter Edition: $39.99, Deluxe: $74.99, and Premier: $104.99)

|

|

RichOrPoor |

Try it free. But the cost is $29.95 after 30 days. The 30 days trial is really great because it comes without any functional limits

|